From HostingAdvice

Digital Dilemma: Residents of Lakewood Reject Smart Tech, Citing ‘Big Brother’ Fears, Reveals Study.

- Survey reveals the cities most supportive, and most skeptical of smart city technology.

- Residents of Denver the most supportive, whereas those from Lakewood are skeptical.

- Infographic included showing study results.

For years, public policy experts have forecasted the rise of smart cities across the U.S., envisioning urban environments that enhance online connectivity, streamline infrastructure, and improve public safety. However, public opinion is increasingly divided. While some welcome the benefits, many are concerned about the potential downsides – chief among them, the fear of a “Big Brother” society where constant online surveillance undermines privacy, a reality already observed in some parts of the world, like China.

HostingAdvice carried out a survey of 3,000 respondents to take the pulse of the nation when it comes to the introduction of truly connected smart cities. The survey revealed that Los Angeleans are most in favor of converting theirs into a smart city. And who can blame them? By using AI algorithms, smart transportation systems can dynamically adjust traffic signals and manage and predict traffic patterns to address the city’s notorious bumper-to-bumper traffic.

Residents of New York City followed in second place in the survey, which again is understandable, given that city’s heavy traffic, which commuters who travel via the Brooklyn-Queens Expressway would attest to.

The top 5 cities whose residents are most enthusiastic to become fully integrated smart cities:

1. Los Angeles

2. New York City

3. Buffalo

4. Dallas

5. Jacksonville

When it comes to Colorado cities, 3 emerged as supportive of smart technology and would broadly embrace it. These were: Denver, Fort Collins, and Aurora.

However, residents of Colorado Springs and Lakewood were skeptical of embracing smart city technology and would vote to reject it.

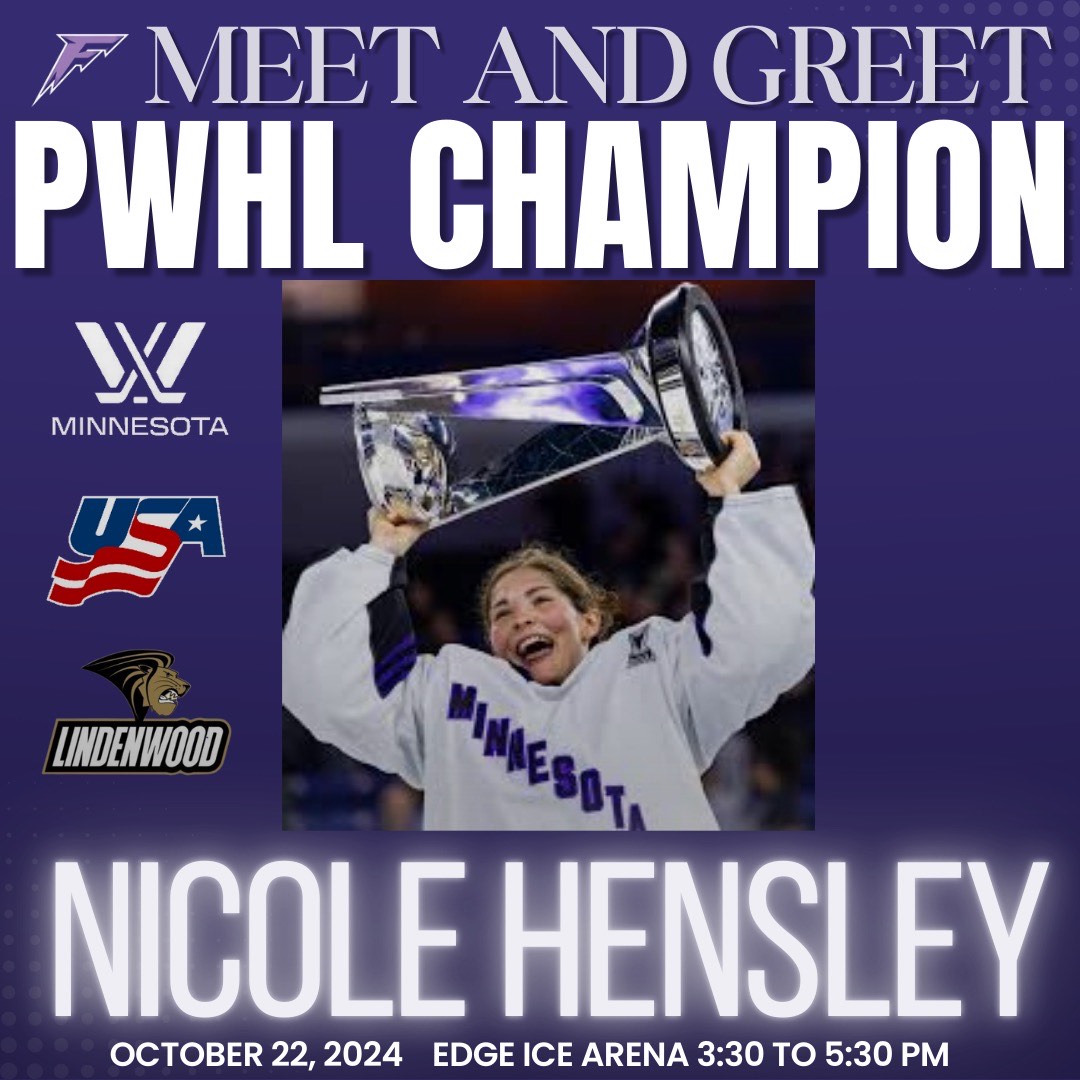

Infographic showing survey results

HostingAdvice asked respondents who were supportive of smart-city technology which aspects of it most appeals to them. Thirty-two percent cited more efficient infrastructure and transportation – improving rush hour traffic congestion appears to be the biggest draw. The second most popular factor is the improved environmental sustainability that can be brought about by smart technology. This comes as no surprise after another blistering summer across the country – fighting climate change has become increasingly important to many people. Twenty-four percent identified increased public safety as the most desired benefit, followed by better online connectivity (14%).

However, as much as there is a willingness by some to embrace smart technology in their public spaces, a significant proportion of respondents are against it. HostingAdvice quizzed respondents on their primary concerns. The biggest concern (24%) is a potential loss of privacy due to increased surveillance. Many worry that smart cities in Colorado may lead to environments, such as Chongqing in China, a city of 30 million people, that is reported to have one of the highest concentrations of surveillance cameras in the world, with around 2.6 million cameras installed throughout the city. Critics argue that Chongqing’s vast surveillance network, including millions of cameras with facial recognition technology, represents a significant invasion of personal privacy. This technology allows the government to track individuals’ movements and activities in real time, raising fears about constant monitoring and lack of personal freedom.

Another concern includes data security, hacking risks, and unwanted government control or interference (28%). Lastly, 10% of respondents said they worry about a lack of transparency about how their data is used. Indeed, when HostingAdvice asked Coloradans their opinions on the likelihood that smart cities could lead to a “Big Brother” society, over half (52%) said that scenario was ‘very likely’ or ‘’likely’.

When respondents were asked whether they feel comfortable living in a city where online surveillance is used to enhance public safety, 57% said they were in favor. In fact, over two-thirds (70%) said they believe the benefits of smart cities outweigh the potential risks to privacy.

Finally, respondents were asked what they believe are the biggest challenges to implementing smart cities:

Cost of infrastructure development (32%)

Public opposition due to privacy concerns (19%)

Cybersecurity threats (18%)

Technological limitations (16%)

Government regulations (15%)

“While the advantages of smart innovations are undeniable, it’s important we acknowledge residents’ concerns over privacy and how their data is handled. A truly smart city isn’t just about the tech – it’s about building trust and ensuring that these advancements genuinely improve the quality of life for everyone,” says Christina Lewis of HostingAdvice.